A new Rate T has developed.

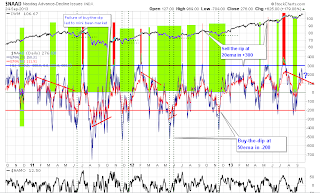

T-Theory uses 30-Year Treasury Yield $TYX to estimate future dates of meaningful lows, major corrections and periods of softness (sideways volatile consolidation) in broad stock market ($SPX, $NYA). Although dates are known in advance, it is not possible to predict what kind of a low may occur, at what price level, whether it will be higher or lower low or even last correction low before rally starts. Plus, there is a margin of error of no more than 10%.

Over the past 10 years or so, it has been prudent to lighten up portfolio of stocks well before Rate T projected dates hit, so ample funds will be available to do some buying on downlow. Spread your bets, reduce size, widen stops - we are already in the midst of historical bear market, that may get whole lot more historical.

21-23 Rate T started with high in 30yr Yield of 2.5% on week of March 15, 2021. There are two minor highs of 2.4% - first one happen 3 weeks prior and last high was on week of May 10. (As of this writing, "last high" already hit one of its projections)

There are two possible placements for centerpost of the T - Time Symmetry Projection - producing 2 sets of time targets for when a low in stocks may occur.

The Low of this move in rates at 1.67% on week of November 29, 2021 produces 37 weeks Rate T with target on week of August 15, 2022 (July 25-Sept 6, considering margin of error).

Last Low Before Breakout at 2.07% on week of February 28, 2022 produced 50 week Rate T with target on week of February 13, 2023 (Jan 9 - March 20, considering margin of error).

IMNSHO, this relatively small Rate T has so many wiggles so close together - its practically a guarantee we gonna have a non stop volatile circlejerk (punctuated by few moments of sheer horror) from here and all the way to Spring of 2023.

Projections of 21-23 Rate T:

June 21, Aug 15, Aug 29, 2022. Dec19, Feb 13, Mar 6, 2023.