.this update covers activity from 8/18/14 to 9/17/2014.

System12BCM:

http://stockcharts.com/freecharts/candleglance.html?MSFT,BRK/B,AAPL,PTR,PG,IBM,GOOGL|B|P5,3,3|0

System 12 is still light with 5 slots available.

I made a serious mistake. While S12 was light, and there was nothing I could take from MD, I was suppose to go for any available of SD. Specifically CHL and HSBC were on my list to buy, but I didn't (for whatever misguided reason). Now China Mobil (CHL) is in Mega Dozen, extended as fuck, without me in it. I don't know how to deal with such 'operator error' - I was supposed to play the system, instead I decided to screw with it. Not good...

I think its only second Emergency Exit (EE) since S12 started, and it happened on AAPL just a couple of days from big announcement... two phones and a watch... lol

BOT: JPM on 8/19; JNJ on 8/21; WFC on 8/29; WMT on 9/3; GE on 9/8

SLD: AAPL on 9/3 EE!

DIVI received: MSFT, JNJ

FB, BHP, IBM, PFE

This is MD:

http://stockcharts.com/freecharts/candleglance.html?AAPL,XOM,GOOGL,MSFT,BRK/B,JNJ,RDS/B,WFC,GE,CHL,PTR,WMT|B|P5,3,3|0

MD Control: CVX, NVS out; CHL, PTR in

XOM, GE, WMT are toying with 'disqualified'.

I don't have XOM, WFC, JNJ, RDS/B, GE, WMT, CHL

I don't see any earnings coming up.

This is SD:

http://stockcharts.com/freecharts/candleglance.html?CVX,NVS,PG,JPM,HSBC,VZ,TM,FB,BHP,IBM,PFE,KO|B|P5,3,3|0

T is out; KO is in

I have PG and IBM; PTR moved up into MegaDozen (MD).

This is Arnott Overlay (AO):

XOM, GE, WFC, BRK, AAPL for 20% each

RAFI 1000 index was rebalanced. Most recent weightings are here (link). Last check 7/29/2014.

http://stockcharts.com/freecharts/candleglance.html?SPY,PRF,XOM,CVX,GE,WFC,BRK/A,AAPL,JNJ,MSFT,JPM,ibm|B|P5,3,3|0

Arnott Overlay and System12 Select Theme (AOS12s) of System9.

As of 8/18 it holds BRK, MSFT, GOOGL, IBM and i will gladly buy standard

size positions of anything that gives an entry (up to maximum allocation

of 25% of portfolio)

GURU holdings include: AAPL, JPM, MSFT, PG, WFC

EEBL include: IBM, MSFT, WFC

Daily Global Economic Calendar

Real Time Economic Calendar provided by Investing.com.

Monday, August 18, 2014

Sunday, August 10, 2014

KREM v1

Meaning of word 'krem' from UrbanDictionary (link) :

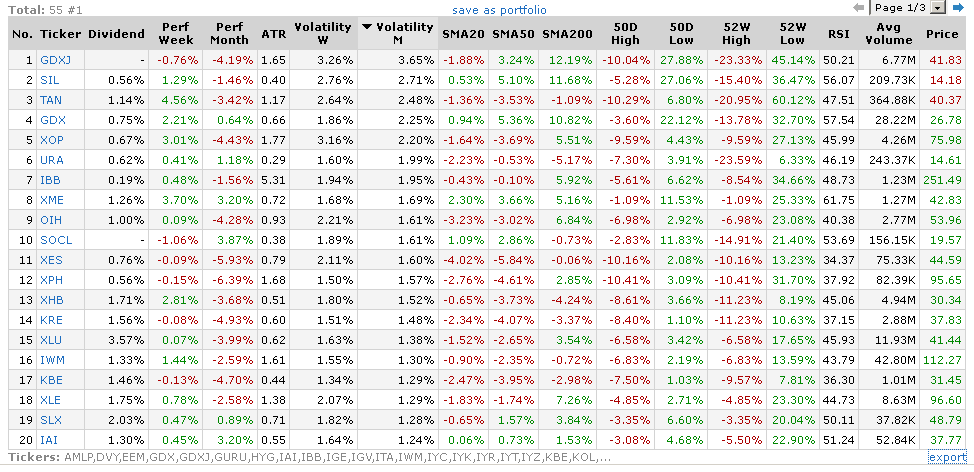

I got a couple of interesting ideas from Perry Kaufman (link), about rotating through a list of ETF's. This way of thinking is actually quite natural for me, as I compiled a list of all kinds of etf's over past few years. Actually 55 US long-only, non-leveraged equity etfs, covering soup to nuts of investable stock universe. There are, of course, several ways to use it. Version 1 takes on most volatile and highest performing etf's, with goal to trade them opportunistically for a meaningful swing. In honor of industrious Mr. Kaufman (who wrote 1200 page book, covering every investment topic known to men), I call this thing KREM - Kaufman Rotational ETF Method.

List:

AMLP,DVY,EEM,GDX,GDXJ,GURU,HYG,IAI,IBB,IGE,IGV,ITA,IWM,IYC,IYK,IYR,IYT,IYZ,KBE,KOL,KRE,MDY,MOO,OIH,PFF,PHO,PPH,PSP,QQQ,REMX,SEA,SIL,SKYY,SLX,SMH,SOCL,SPY,TAN,URA,VGT,XES,XHB,XLB,XLE,XLF,XLI,XLK,XLP,XLU,XLV,XLY,XME,XOP,XPH,XRT

Finviz link

8/2015. add FFTY, HACK, ITB.

10/2015. add MarketVectors retail RTH. Also RTH is bigger than XRT (equal? weight retail from SPDR)

12/2015. add FDN - internet with FANG at 35%

10 most volatile, highest performing funds selected, after removing duplicates and applying a filter. Then 2 additional etf's added to improve diversification. This becomes KREM Index, equally weighted and rebalanced monthly. I will update it between 5th and 10th.

KREM August 2014 Index:

http://stockcharts.com/freecharts/candleglance.html?TAN,GDX,XOP,URA,IBB,XME,SOCL,XES,XPH,XHB,KRE,XLU|B|P5,3,3|0

Best performer - XME

System12 Qualified - GDX, XME, SOCL, XOP, XPH, XLU

They may not look too hot right now, but only 10 etf's are up for a month, so ... One thing I can say about this index components for sure is: They Move! All my efforts need to be confined to this list for the month until rebalanced. The only snag is portfolio impact - I really don't want to heavily overweight anything. Considering that I already have corresponding industry components as open positions, I removed XOP, XPH, GDX and replaced them with SLX, KOL, SEA at my sole discretion.

KREM BCM Action List (KAL):

http://stockcharts.com/freecharts/candleglance.html?TAN,URA,IBB,XME,SOCL,XES,XHB,KRE,XLU,slx,kol,sea|B|P5,3,3|0

Understanding, I rather trade correlated stocks in groups vs etf's/funds, still KREM considerably narrows down my instrument selection. This strategy needs to be applied to System9, but i still have some kinks to be worked out.

There is also another possibility, I haven't tested yet.

9 main spiders - is essentially the whole market.

First of all I am curious to see how they respond to CSI, as I think its the best way to construct average market CSI score - an ultimate tool I've been dreaming of... lol. Of course, there is no 'holy grail', its just an illusion (hopefully not delusion), but I would like to add some kind of broad market indicator to compliment MADI. There is nothing out there to help me answer the most important questions: WHAT to buy, WHEN to do it, HOW to bet, WHY to sell. I have to keep figuring this out myself.

Secondly, considering that 9 main sectors are lower-volatility than most on my list, I wonder what will happen to portfolio of corresponding Fidelity mutual funds? I can allocate to best performing, overweight according to CSI, time entry by MADI, re-balance monthly for free. I think S12 exit rules are the best for this, as they allow to stay in the longest and re-enter quickly, but it remains to be seen

========================================================

KREM 2014:

http://stockcharts.com/freecharts/candleglance.html?SPY,QQQ,IWM,MDY,EEM,HYG,DVY,PFF,PSP,GURU,AMLP,XLU|B|0

http://stockcharts.com/freecharts/candleglance.html?XLK,SMH,VGT,IGV,IYZ,SOCL,SKYY,XLF,KRE,KBE,IAI|B|0

http://stockcharts.com/freecharts/candleglance.html?XME,GDX,GDXJ,SIL,KOL,SLX,IGE,XLE,XOP,XES,OIH|B|0

http://stockcharts.com/freecharts/candleglance.html?XLI,XLB,XHB,IYR,TAN,URA,REMX,PHO,MOO,SEA,IYT,ITA|B|0

http://stockcharts.com/freecharts/candleglance.html?XLV,IBB,XPH,PPH,XLP,XLY,XRT,IYK,IYC|B|0

8/2015. add FFTY, HACK.

A crazy ass motherfucker, who can not calm down, doesn't give a shit what he says, and acts extremely black for the white tone of his skin.No its not that.

I got a couple of interesting ideas from Perry Kaufman (link), about rotating through a list of ETF's. This way of thinking is actually quite natural for me, as I compiled a list of all kinds of etf's over past few years. Actually 55 US long-only, non-leveraged equity etfs, covering soup to nuts of investable stock universe. There are, of course, several ways to use it. Version 1 takes on most volatile and highest performing etf's, with goal to trade them opportunistically for a meaningful swing. In honor of industrious Mr. Kaufman (who wrote 1200 page book, covering every investment topic known to men), I call this thing KREM - Kaufman Rotational ETF Method.

List:

AMLP,DVY,EEM,GDX,GDXJ,GURU,HYG,IAI,IBB,IGE,IGV,ITA,IWM,IYC,IYK,IYR,IYT,IYZ,KBE,KOL,KRE,MDY,MOO,OIH,PFF,PHO,PPH,PSP,QQQ,REMX,SEA,SIL,SKYY,SLX,SMH,SOCL,SPY,TAN,URA,VGT,XES,XHB,XLB,XLE,XLF,XLI,XLK,XLP,XLU,XLV,XLY,XME,XOP,XPH,XRT

Finviz link

8/2015. add FFTY, HACK, ITB.

10/2015. add MarketVectors retail RTH. Also RTH is bigger than XRT (equal? weight retail from SPDR)

12/2015. add FDN - internet with FANG at 35%

10 most volatile, highest performing funds selected, after removing duplicates and applying a filter. Then 2 additional etf's added to improve diversification. This becomes KREM Index, equally weighted and rebalanced monthly. I will update it between 5th and 10th.

KREM August 2014 Index:

http://stockcharts.com/freecharts/candleglance.html?TAN,GDX,XOP,URA,IBB,XME,SOCL,XES,XPH,XHB,KRE,XLU|B|P5,3,3|0

Best performer - XME

System12 Qualified - GDX, XME, SOCL, XOP, XPH, XLU

They may not look too hot right now, but only 10 etf's are up for a month, so ... One thing I can say about this index components for sure is: They Move! All my efforts need to be confined to this list for the month until rebalanced. The only snag is portfolio impact - I really don't want to heavily overweight anything. Considering that I already have corresponding industry components as open positions, I removed XOP, XPH, GDX and replaced them with SLX, KOL, SEA at my sole discretion.

KREM BCM Action List (KAL):

http://stockcharts.com/freecharts/candleglance.html?TAN,URA,IBB,XME,SOCL,XES,XHB,KRE,XLU,slx,kol,sea|B|P5,3,3|0

Understanding, I rather trade correlated stocks in groups vs etf's/funds, still KREM considerably narrows down my instrument selection. This strategy needs to be applied to System9, but i still have some kinks to be worked out.

There is also another possibility, I haven't tested yet.

9 main spiders - is essentially the whole market.

First of all I am curious to see how they respond to CSI, as I think its the best way to construct average market CSI score - an ultimate tool I've been dreaming of... lol. Of course, there is no 'holy grail', its just an illusion (hopefully not delusion), but I would like to add some kind of broad market indicator to compliment MADI. There is nothing out there to help me answer the most important questions: WHAT to buy, WHEN to do it, HOW to bet, WHY to sell. I have to keep figuring this out myself.

Secondly, considering that 9 main sectors are lower-volatility than most on my list, I wonder what will happen to portfolio of corresponding Fidelity mutual funds? I can allocate to best performing, overweight according to CSI, time entry by MADI, re-balance monthly for free. I think S12 exit rules are the best for this, as they allow to stay in the longest and re-enter quickly, but it remains to be seen

========================================================

KREM 2014:

http://stockcharts.com/freecharts/candleglance.html?SPY,QQQ,IWM,MDY,EEM,HYG,DVY,PFF,PSP,GURU,AMLP,XLU|B|0

http://stockcharts.com/freecharts/candleglance.html?XLK,SMH,VGT,IGV,IYZ,SOCL,SKYY,XLF,KRE,KBE,IAI|B|0

http://stockcharts.com/freecharts/candleglance.html?XME,GDX,GDXJ,SIL,KOL,SLX,IGE,XLE,XOP,XES,OIH|B|0

http://stockcharts.com/freecharts/candleglance.html?XLI,XLB,XHB,IYR,TAN,URA,REMX,PHO,MOO,SEA,IYT,ITA|B|0

http://stockcharts.com/freecharts/candleglance.html?XLV,IBB,XPH,PPH,XLP,XLY,XRT,IYK,IYC|B|0

8/2015. add FFTY, HACK.

Wednesday, August 6, 2014

Guru Puja

I often say that 'Luck favors prepared'.

I often say that 'Luck favors prepared'.Apparently this is loosely based on famous Seneca quote: "Luck is what happens when preparation meets opportunity". To the best of my knowledge, Seneca the Youngest was the earliest recorded bond speculator in human history. While being an advisor to Roman Emperor Nero, he managed to force some 'big loans' on British allies of Rome, only to call them back at most 'opportune' time. Bond panic ensued, followed by revolt led by Queen Boudica, lest not forget almost 100,000 killed in uprising. In a year 62AD, Seneca became one of richest citizens of Rome.

'Guru' means 'teacher' in Sanskrit. I don't have one. Which makes me an 'Anatha', or 'the one without a teacher'.

I had many indirect teachers in a way of books and blogs, but after reading and studying for years, I still have many of same concerns. Especially so with modern day bloggers. I can say from personal experience, that its all but impossible to be an active trader/investors and also pursue a writing/publicity career at the same time. The people who know how to make money in the markets don't need AdSense income, unlike majority of financial blog writers who can't tell shit from shinola. IMNSHO, reading blogs waists time, is a distraction, often source of misinformation or somebody's agenda, spreads fear (because it attracts muppets like flies), and generally full of bullshit. Plus they always trying to sell me something. I can sell myself, if I would want to... , but I refuse to become a scammer. I rather just to follow the money.

I learned to read stock charts to find 'breadcrumbs'- traces of Big Money, often buying something alongside famous money managers (of course, that info comes out too late). The problem is - it happens not often enough. The idea of following approach is to position myself in the middle of their universe...

I have to admit, it's a bit of short-cut.

Programming note: this method is labeled 'GURU'.

------------------------------------------------------------------------

GURU ETF from GlobalX tracks Top Guru Holdings Index made by index gurus of Structured Solutions AG, Germany. They compile a list of 50 most invested stocks, reported by top hedge funds in their Form 13F. There is a lag in when these purchases are reported, and again for allocation into etf. Supposedly they lean towards managers with low portfolio turnover, so I assume that stocks are locked away for 6-18 months. It doesn't mean they always right, only that there is (or was) a large monetary bet with reasonable expectation of gain. Composition is rebalanced often, so I will check in the beginning of every month, around 5th. I think that a new positions will have a higher chance for success. I don't know how large the rotation really is, don't have any historical data, so will have to study in real time.

http://www.globalxfunds.com/GURU

http://etfdb.com/etf/GURU/

Finviz screen as of 8/5/2014 here (link).

After taking out stocks I already have in System12 or elsewhere, and focusing only on issues above 50/200ma, I am left with only 11.

http://stockcharts.com/freecharts/candleglance.html?GURU,AMX,BIDU,PCLN,EMC,AMT,CP,HES,CCI,CIT,SAVE,BURL|B|P5,3,3|0

The plan is to take any sound technical entry with stop-loss near by; and then half-out on any pop, to secure early gains. Don't care about any fundamentals or news, assuming that somebody already done that, or maybe there is something else at play. These stocks span the whole gamut of investing universe - variety of industries, from absurd P/E to no/E, from 32% SI in S to no shorts at all in ING, from 52 week high to yearly lows. GURU holdings are big stocks - most are over 10bil market cap, smallest is 1.6bil (CACI).

----------------------------------------------------------------------------

While Digging (post link) in April, I rounded up some local gurus.

Clever Eddy Elfenbein of CrossingWallStreet.com, proclaimed a 'best buy-and-hold blogger', with his Buy List. A collection of 20 stocks, set in a beginning of the year. He mentioned that not all should be held continuously. This fits with my efforts to trade opportunistically the very best, sound businesses.

Latest rundown: http://www.crossingwallstreet.com/archives/2014/08/cws-market-review-august-15-2014.html

Eddy Elfenbein Buy List (EEBL):

http://stockcharts.com/freecharts/candleglance.html?$SPX,IWM,VTV,VUG,AFL,BBBY,CA,CTSH,BCR,DTV,EBAY,ESRX|B|P5,3,3

http://stockcharts.com/freecharts/candleglance.html?FISV,F,IBM,MCD,MDT,MSFT,MOG/A,ORCL,QCOM,ROST,SYK,WFC|B|P5,3,3

That man has been a fruitful source of great research ideas. One of his latest gems is a list of 52 'dull' stocks of well-run, profitable companies that get very little or no coverage by analysts and media. I have never heard about most of them, which makes me very very very curious.

http://www.crossingwallstreet.com/archives/2014/08/the-dull-stock-portfolio.html

Thanks, Eddy

------------------------------------------------------------------------

Old Man Buffet

Here is his top 2 dozen as of end 2013, from WFC 20% to MTB at 0.5% of portfolio:

http://stockcharts.com/freecharts/candleglance.html?WFC,KO,AXP,IBM,PG,XOM,WMT,USB,DTV,DVA,GS,PSX|B|P5,3,3

http://stockcharts.com/freecharts/candleglance.html?MCO,GM,GHC,USG,BK,CBI,COP,LMCA,NOV,VIA,VRSN,MTB|B|P5,3,3

Notable that BAC is not here, but actually its his 5th largest position (thru warrants and shit...).

http://whalewisdom.com/filer/berkshire-hathaway-inc

-----------------------------------------------------------------------

Very Smart Robert Arnott of Research Affiliates and his RAFI family of indexes, providing yet another view of investment selection. Arnott Overlay (post link) in spring of this year turned out to be just a start of this cross-strategy project, in effort to 'follow the money'.

...Much to be discovered...

Subscribe to:

Posts (Atom)