I actually hit AUM low point in early May. Positions I was carrying in April didn't respond well to earnings. I was stopped out of almost everything with small gains and losses. System 12 was a saving grace, performing much better than in any tests. Luck favors prepared. As I was Digging around (post-link) and reviewing old lists, new scans and my own sanity, I slowly put BCM account back on full margin after being sick in a Box (post-link). Right on time for a late May rip. I haven't made any new purchases in days, sold a couple of things along the way, and now just trailing stops. All positions are in profit, except PPP (-2%). Some met early targets, all have more higher targets ahead... just need to survive a shake-out...

http://stockcharts.com/freecharts/candleglance.html?geo,ppp,sea,fxi,rsx,dhi|B|P5,3,3|0

Last time I looked at SPX prospects was during Fishing Expedition (post-link) in March'14, correctly analyzed but poorly executed attempt to pick a minor bottom. I wrote:

Fib target ... is 1898. My point-n-figure targets are 1974-1978, followed by 2115 (what?)... Lets first get to 1890, then we will see.1897.28 happen right on a day of Bloodbath 1% of ATFH (post-link), all part of 50 Day Box (post-link).

I didn't pick the bottom. Fishing Expedition costed me a bit over 10%. Rotation out of prior market leaders, small caps and Bloodbath showed another 10% of losses. Helluva way to start a business, thou kinda typical for me. Every new endeavor of mine always had a rocky beginning.

I made some important changes while Sitting on a Fence (post-link) in late March, ordered myself to Charlie Mike (post-link) in early April, continued Digging (post-link) despite early setbacks, and now I see the fruits of my labor. Correct!

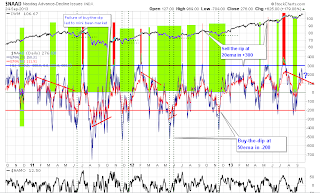

As SPX approaches my initial PF Targets of 1975ish, I astonishingly note that they been adjusted even higher, to well over 2000! In fact the closest target is 2023, followed by 2125ish and 2200 (what? what?!!). There are also Measured Move (MM) targets - one met, another one at 1975 again.

-----------------------------------------

Important observation is low volume on this rally. I heard and read several analysis of how this is a warning sign. True- 70's, 80's and even 90's bull advances where traditionally accompanied by higher volume, illustrating increasing interest and activity. Last 10 years show nothing of a kind. Up markets of late have been characterized by relatively low volume, diminishing every year. High volume days are mostly exhaustion and marks the top. What really happens is summer market started a week before Memorial Day. Volume and activity until 11-12ish, followed by mostly sideways on no volume at-all, and flat overnight. Very low VIX and plenty of shorts to squeeze in most hated bull market in history. How long it lasts? Until it doesn't.

ES expiration is less then 2 weeks away (on 20th). Its very similar to last one (here), in a way of Open Interest (OI) too high at over 3mil cars. Ones again shorts are caught overexposed and running out of time. Fortunately it doesn't matter to me, as I am fully invested and looking to take profits on trailing stops in BCM account. System 9 is a different story, as it holds more positions in diversified portfolio.

-----------------------------------------

There are no important news I am aware of.

-----------------------------------------

Solar activity is very low. Geomagnetic had been quiet for weeks (may be months), until lonely storm couple of days ago.

----------------------------------------

I have a T running out in June, Bradley top date in July, MADI too high for its own good, Golden Indicator still pointing up and no Confidence (via CI) to speak of. I'd like to see this rally run its course and review internal indicators then. Wondering if there is any Astrological thingamabob sometimes soon... Is there such a thing as Bear Market, or is it just an old wife tales?.. Buckwheats...