Small caps and Naz100 are weak and leading down. Financials XLF dipped below 50DMA ahead of SPX.

Naz A/D indicator is very weak.

................................................................................................................

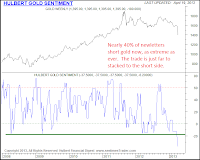

April 19 GOLD Sentiment

40% of newsletter writers recommend shorting Gold - this is most bearish since 2008

April 18 GOLD - Physical demand

The U.S. Mint in April has sold 153,000 ounces of American Eagle gold coins, the highest in almost three years, after futures prices started the week by plunging the most since 1980.

Sales have more than doubled from March and surged sevenfold from a year earlier, data on the Mint’s website showed. The amount for all of May 2010 was 190,000 ounce.

This week, retail sales and jewelry demand soared in India, the world’s top gold buyer, and China, the second-biggest, after futures in New York slumped into a bear market, touching the lowest in more than two years. Coin sales also surged in Australia.

April 17 GOLD

CME Hikes Gold, Silver Margins By 18.5%. Only big boys are allowed to play.

April 15, 2013 Monday. GOLD falls $150 to low 1335 (close 1361). Half of that drop happened overnight before US market opened. Volume 657090 cars !!! Highest volume of that day came shortly after open, as gold broke 1400

April 14 GOLD - HFT

The implication is that HFT bots driving gold down. They are perfectly designed to chew through bid structures, and that's what you see above. They are 'digesting' all the orders that were still on the books for gold, to remove them so that lower and lower stops could be run. Charts and explanation are from http://www.peakprosperity.com/blog/81535/gold-slam-massive-wealth-transfer-our-pockets-banks

I had no idea that Gold is liquid enough to handle these machines.

April 12, 2013 Friday. GOLD falls $88 to 1501

Goldman Sachs now expects gold to fall to $1,450 an ounce by the end of the year; the company’s original forecast was around $1,810. By the end of 2014, the company believes the precious metal will falter even more, falling to $1,270. Goldman’s 12-month gold outlook also fell from $1,550 to $1,390. Goldman also cut its short-term outlook, cutting its three-month forecast from $1,615 to $1,530 an ounce.

COTTON

Beijing–through the China Cotton Association–has agreed to extend its stockpiling program of the commodity, and will renew cotton stockpiling from September 2013 to March 2014, with no upper limit on purchases.

...............................................................................................................

I will start to track some of the news. Not because it helps in routine trading. It doesn't. But because markets can't fall without some "shaking of the tree". News cycle has been very quite and benign ever since the beginning of the year, which is unnatural. I strongly believe that some of the news are in fact a "warning shot across the bow", something that changes the balance of things, but often understood only with benefit of hindsight. Still I remember very clearly that I saw right thru all the BS about Jerome Kerviel back in 2008. Kid was softly setup to take a fall for some 500 million in losses for Société Générale (SoGen is a europian equivalent of Goldman Sachs), allowing the bank to get out of massive position in US markets right before Sub-Prime crisis began.

The idea is to plot biggest news on a chart for future use.

In The News:

April 16

Letters containing deadly ricin poison received by Presidents office, some senators and judge. No casualties. Suspect apprehended 2 days later and appears crazy.

April 15 Boston Marathon Bombing. Chechen's involved.

April

North Korea threatens nuclear attack, severs ties with South Korea. TV is full of cartunish videos of their mid-20th Century army and rockets and that fat kid (Lil Kim). It did get people scared.

Congress coming back from vacation, get a budget from president that is bigger than before, shots down gun legislation. Starting to shake the news a bit.

Bitcoin bubble. 40 to 265 in days, than back to less than 80 in hours.

Japan announces that not only they will print money, but also buy bonds, stocks, ETF's and real estate for next 2 years.

Numerous announcements of local and other taxes going up. Cost of doing business is thru the roof.

Beginning of April - Bird Flu outbreak in China. Some people died. Human-to-human transmission suspected, but denied by Chinese authorities.

Beginning of March - Cyprus bank crisis. Bank holiday, depositors looted, bailout failed, followed by rumors of their gold reserve sales. Germany approved bailout on April 18

No comments:

Post a Comment