A crazy ass motherfucker, who can not calm down, doesn't give a shit what he says, and acts extremely black for the white tone of his skin.No its not that.

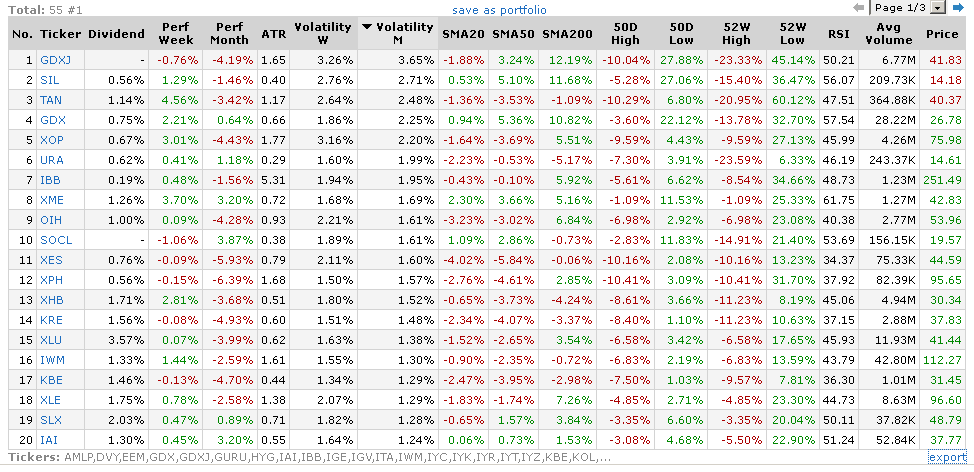

I got a couple of interesting ideas from Perry Kaufman (link), about rotating through a list of ETF's. This way of thinking is actually quite natural for me, as I compiled a list of all kinds of etf's over past few years. Actually 55 US long-only, non-leveraged equity etfs, covering soup to nuts of investable stock universe. There are, of course, several ways to use it. Version 1 takes on most volatile and highest performing etf's, with goal to trade them opportunistically for a meaningful swing. In honor of industrious Mr. Kaufman (who wrote 1200 page book, covering every investment topic known to men), I call this thing KREM - Kaufman Rotational ETF Method.

List:

AMLP,DVY,EEM,GDX,GDXJ,GURU,HYG,IAI,IBB,IGE,IGV,ITA,IWM,IYC,IYK,IYR,IYT,IYZ,KBE,KOL,KRE,MDY,MOO,OIH,PFF,PHO,PPH,PSP,QQQ,REMX,SEA,SIL,SKYY,SLX,SMH,SOCL,SPY,TAN,URA,VGT,XES,XHB,XLB,XLE,XLF,XLI,XLK,XLP,XLU,XLV,XLY,XME,XOP,XPH,XRT

Finviz link

8/2015. add FFTY, HACK, ITB.

10/2015. add MarketVectors retail RTH. Also RTH is bigger than XRT (equal? weight retail from SPDR)

12/2015. add FDN - internet with FANG at 35%

10 most volatile, highest performing funds selected, after removing duplicates and applying a filter. Then 2 additional etf's added to improve diversification. This becomes KREM Index, equally weighted and rebalanced monthly. I will update it between 5th and 10th.

KREM August 2014 Index:

http://stockcharts.com/freecharts/candleglance.html?TAN,GDX,XOP,URA,IBB,XME,SOCL,XES,XPH,XHB,KRE,XLU|B|P5,3,3|0

Best performer - XME

System12 Qualified - GDX, XME, SOCL, XOP, XPH, XLU

They may not look too hot right now, but only 10 etf's are up for a month, so ... One thing I can say about this index components for sure is: They Move! All my efforts need to be confined to this list for the month until rebalanced. The only snag is portfolio impact - I really don't want to heavily overweight anything. Considering that I already have corresponding industry components as open positions, I removed XOP, XPH, GDX and replaced them with SLX, KOL, SEA at my sole discretion.

KREM BCM Action List (KAL):

http://stockcharts.com/freecharts/candleglance.html?TAN,URA,IBB,XME,SOCL,XES,XHB,KRE,XLU,slx,kol,sea|B|P5,3,3|0

Understanding, I rather trade correlated stocks in groups vs etf's/funds, still KREM considerably narrows down my instrument selection. This strategy needs to be applied to System9, but i still have some kinks to be worked out.

There is also another possibility, I haven't tested yet.

9 main spiders - is essentially the whole market.

First of all I am curious to see how they respond to CSI, as I think its the best way to construct average market CSI score - an ultimate tool I've been dreaming of... lol. Of course, there is no 'holy grail', its just an illusion (hopefully not delusion), but I would like to add some kind of broad market indicator to compliment MADI. There is nothing out there to help me answer the most important questions: WHAT to buy, WHEN to do it, HOW to bet, WHY to sell. I have to keep figuring this out myself.

Secondly, considering that 9 main sectors are lower-volatility than most on my list, I wonder what will happen to portfolio of corresponding Fidelity mutual funds? I can allocate to best performing, overweight according to CSI, time entry by MADI, re-balance monthly for free. I think S12 exit rules are the best for this, as they allow to stay in the longest and re-enter quickly, but it remains to be seen

========================================================

KREM 2014:

http://stockcharts.com/freecharts/candleglance.html?SPY,QQQ,IWM,MDY,EEM,HYG,DVY,PFF,PSP,GURU,AMLP,XLU|B|0

http://stockcharts.com/freecharts/candleglance.html?XLK,SMH,VGT,IGV,IYZ,SOCL,SKYY,XLF,KRE,KBE,IAI|B|0

http://stockcharts.com/freecharts/candleglance.html?XME,GDX,GDXJ,SIL,KOL,SLX,IGE,XLE,XOP,XES,OIH|B|0

http://stockcharts.com/freecharts/candleglance.html?XLI,XLB,XHB,IYR,TAN,URA,REMX,PHO,MOO,SEA,IYT,ITA|B|0

http://stockcharts.com/freecharts/candleglance.html?XLV,IBB,XPH,PPH,XLP,XLY,XRT,IYK,IYC|B|0

8/2015. add FFTY, HACK.

No comments:

Post a Comment